Introduction:

Social Security Numbers (SSNs) play a crucial role in the United States, serving as a unique identifier for individuals and facilitating various government and financial transactions. Issued by the Social Security Administration (SSA), SSNs are an essential component of the American social and economic framework. In this article, we’ll explore the fullz info, structure, and significance of Social Security Numbers.

Purpose of Social Security Numbers:

The primary purpose of an SSN is to track individuals for Social Security and taxation purposes. Established in 1936 under the Social Security Act, this nine-digit number was initially intended to track workers’ earnings and calculate their Social Security benefits. Over time, the use of SSNs expanded beyond the original scope, and they are now used for a variety of identification purposes, such as opening bank accounts, applying for credit, and accessing government services.

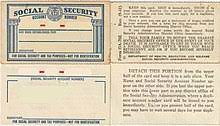

Structure of Social Security Numbers:

Understanding the structure of SSNs is essential for recognizing their validity and determining information encoded within them. The nine digits are divided into three segments: the area number, the group number, and the serial number. The first three digits represent the area number, which originally indicated the state in which the SSN was issued. The next two digits form the group number, and the final four digits represent the serial number.

Significance in Financial Transactions:

SSNs are a critical component in financial transactions and credit reporting. When applying for credit cards, loans, or mortgages, individuals are often required to provide their SSN to allow lenders to assess creditworthiness. It is crucial for individuals to safeguard their SSNs to prevent identity theft and unauthorized access to their financial information.

Protection and Security:

Given the sensitive nature of SSNs, it is vital for individuals to take steps to protect this information. Identity theft remains a significant concern, and unauthorized access to SSNs can lead to financial fraud and other serious consequences. Individuals should refrain from sharing their SSN unnecessarily, use secure channels for transmitting this information, and regularly monitor their financial statements for any suspicious activity.

Social Security Number and Employment:

Employers also play a role in the administration of SSNs. When hiring employees, companies are required to collect and report their workers’ SSNs for payroll and tax purposes. Employers must also verify the identity and work eligibility of employees through the completion of Form I-9, which may require providing an SSN.

Conclusion:

Social Security Numbers are a cornerstone of the American social and economic system, serving as a unique identifier with broad applications. While their original purpose was for Social Security and taxation, SSNs are now integral to various aspects of daily life, including financial transactions and employment. Understanding the structure and significance of SSNs is crucial for individuals to protect themselves from identity theft and ensure the responsible use of this sensitive information in an increasingly digital world.